Life insurance reduces mortality risks in China

Still, the protection gap stood at $73.6b in 2023.

China's life insurance sector, which saw a 12.8% rise in nominal premiums in 2023 (4% in 2022), has spilt over its effects on the overall resiliency of the country.

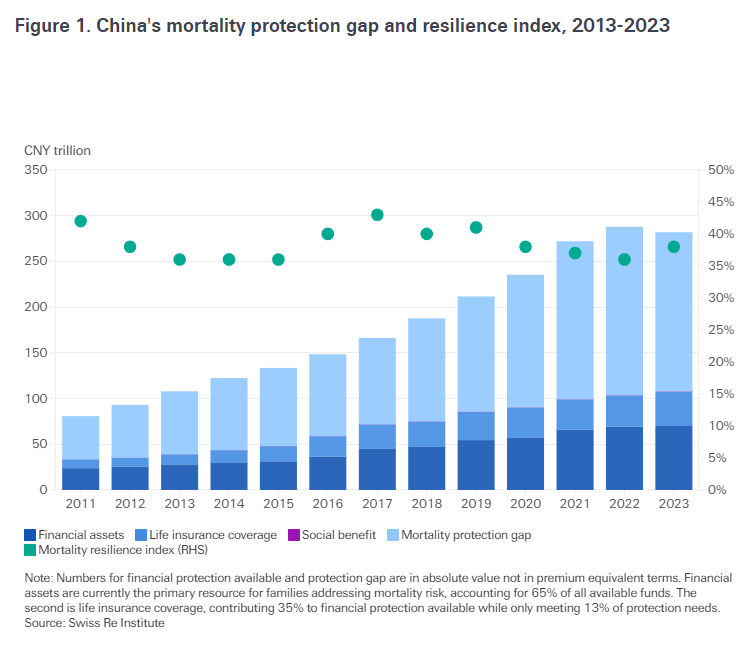

The Swiss Re Institute (SRI) Resilience Index shows a 2.3 percentage point increase, bringing the overall resilience to 38.3%.

This improvement coincides with a 6% reduction in the mortality protection gap of China’s 31 provinces, a measure of the financial shortfall families face following the premature death of a primary earner.

This growth, driven by increased demand and the anticipation of lower guaranteed rates, contributed significantly to the overall resilience, particularly in Beijing and Shanghai, where premiums surged by 21% and 25%, respectively.

However, despite these improvements, the mortality protection gap remains substantial, reaching $73.6b in 2023.

The gap has more than doubled over the past decade, driven by rising household incomes and debt. China's household debt, now at $10.95t (CNY78.3t), has significantly constrained the ability of families to manage financial risks.

The research highlights regional disparities in mortality resilience, with indices ranging from below 15% to over 50%.

Provinces with higher life insurance penetration, particularly in northern and northeastern China, show stronger resilience despite varying levels of economic development.

The study suggests that life insurance is becoming a key tool in managing mortality risk, especially in less economically developed areas.

Looking ahead, the research anticipates continued improvement in mortality resilience across most regions, driven by increased life insurance penetration. The disparity in resilience between regions is also expected to narrow over time.

“Over the long run, mortality resilience is likely to improve in most of China's regions, and the disparity across regions should narrow. We estimate that when life insurance penetration increases by 1%, the mortality resilience index could increase by 6 ppt, keeping other factors unchanged,” the SRI report said.

Advertise

Advertise