South Korea’s life insurance industry to exceed $190b by 2027: GlobalData

One of the driving factors is South Korea’s shrinking ageing population.

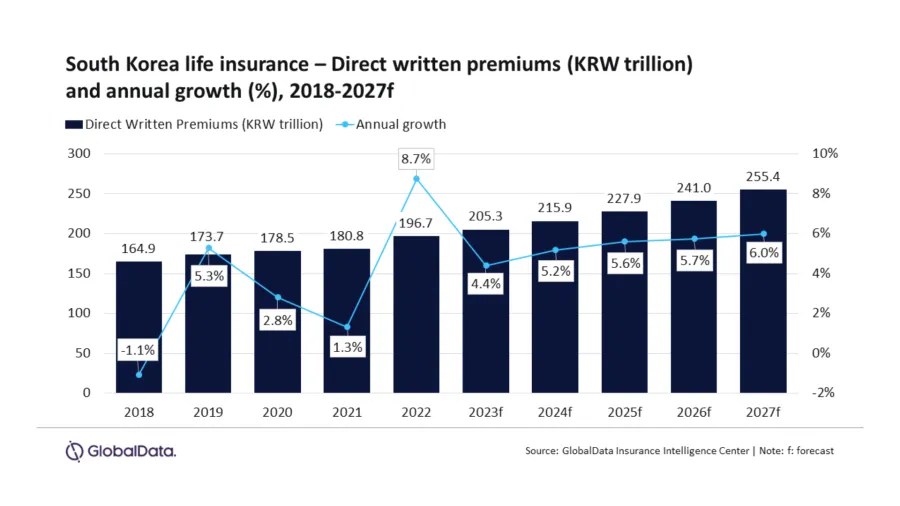

The South Korean life insurance industry is set to experience robust growth, with a projected 5.6% annual increase from 2023 to 2027, reaching KRW255.4t ($191.2b) in direct written premiums (DWP), as reported by GlobalData.

This growth is driven by demographic shifts, including a declining birthrate and an ageing population, amplified demand for pension, long-term care, and whole-life policies.

“The ageing population (aged 65 or more) in South Korea, which accounted for 17.5% of the total population in 2022, is expected to reach 20% by 2025, according to Statistics Korea. The rise in the older population will have a significant impact on the demand for long-term savings life insurance products,” Prasanth Katam, Insurance Analyst at GlobalData said.

Pension insurance, the largest segment, is expected to grow by 7% in 2023, constituting 36.5% of DWP.

Supplementing retirement savings is expected due to the national pension system, and government tax incentives make it more attractive, projecting an 8% CAGR through 2027.

ALSO READ: Life insurance sector in Malaysia to exceed $15.9b by 2027 – GlobalData

Endowment insurance, the second-largest segment with a 14.4% DWP share in 2023, offers appealing interest rates compared to alternatives like bank deposits, forecasting a 12% growth in 2023.

Whole life insurance, comprising 13.2% of DWP in 2023, will see a 3.1% CAGR from 2023 to 2027.

This growth stems from South Korea's ageing population, with the median age projected to rise from 44.5 years in 2023 to 56.5 years by 2050. Insurers also enhance protection and inclusivity in whole life insurance policies, further boosting demand.

“The South Korean life insurance industry is a developed market with a high penetration rate of 9.2% as compared to other regional countries like Japan (6.1%), India (2.9%), New Zealand (1.3%) and Australia (1.1%). Low fertility rates and a rapidly aging population will help in maintaining a modest growth in the life insurance industry over the next five years.” Katam added.

Advertise

Advertise