Singapore insurers to profit over shift to digital initiatives: GlobalData

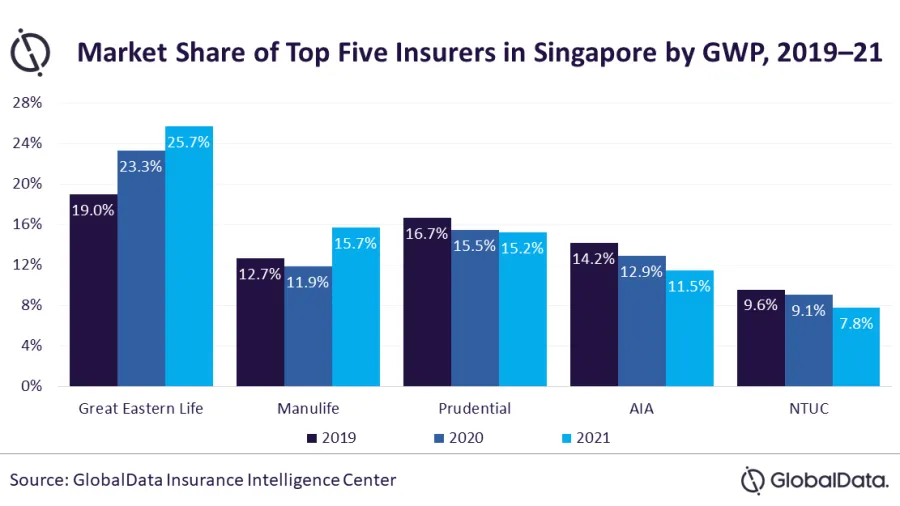

The market share of the top five insurers grew by 3.2 percentage points in 2021.

The insurance industry in Singapore is set to witness a growth in revenue over the coming years, according to data and analytics firm GlobalData.

The positive environment created by easing COVID-19 restrictions and a recovery in global economic activity to pre-pandemic levels has enabled top insurers in the country to improve their offerings. The market share of the top five and top 10 insurers increased by 3.2 percentage points and 0.6 percentage points, respectively, in 2021 compared to 2020, according to GlobalData's report.

The growth has been aided by the scaling of technology and increased adoption of digitalisation, which has enabled insurers to create new opportunities and improve customer experience. To build a resilient business, Singaporean insurers have strengthened their distribution channels by adding digital tools to core channels like agencies, financial advisers, and bancassurance.

Great Eastern Life Assurance continues to lead the Singaporean insurance industry with a market share of 25.7% in 2021, while Manulife jumped up from the fourth position in 2017 to the second largest insurer in 2021. Prudential Assurance slipped to the third spot from the second position in 2017. Amongst the top 10 insurers, Singapore Life registered a triple-digit growth of 272.7% during 2017-21, which helped it to increase its market share to 5.2% in 2021 from 2% in 2020.

Singaporean insurers have also focused on customization to provide support to their customers following the pandemic. For example, NTUC Income Insurance launched low-cost subscription-based customized insurance policies in July 2021.

"Singaporean insurers are expected to continue their profitable growth over the coming years, driven by the shift towards digital initiatives and customization," said Manogna Vangari, insurance analyst at GlobalData.

Advertise

Advertise