StashAway’s Hong Kong assets expand by 20% in Q1

Majority of their assets are from HNW and emerging HNW clients.

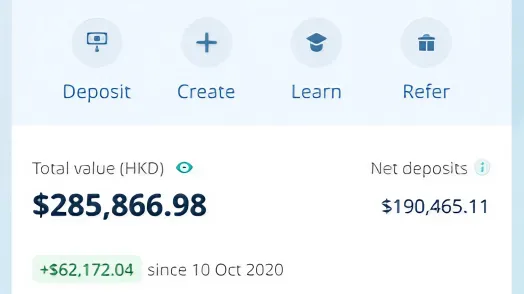

Investment platform StashAway saw its assets under management (AUM) in Hong Kong grow by over 20% in Q1.

The Singapore-based WealthTech attributed this to high net worth (HNW) and emerging HNW clientele– young investors with assets between HK$5m to HK$8m– investing through StashAway Reserve.

Investments by HNW and emerging HNW clients reportedly contributed over 80% to StashAway’s growth in the past 12 months and accounted for 65% of its AUM in Hong Kong.

Existing investors, meanwhile, made up 35% of new deposits, which StashAway attributed to its financial literacy platform StashAway Academy.

ALSO READ: Wealth management industry challenged to rear investors to safe-haven assets

StashAway chief investment officer Stephanie Leung said that the company’s “simple, intelligent, and cost-effective” investment solutions were the reasons for its credit growth.

“Interestingly, we are seeing Hong Kong investors having a higher risk appetite with more equity exposure in their portfolios than other investors in the region, such as Singapore,” she observed.

Advertise

Advertise