The impact of currency appreciation on trade performance in Asia

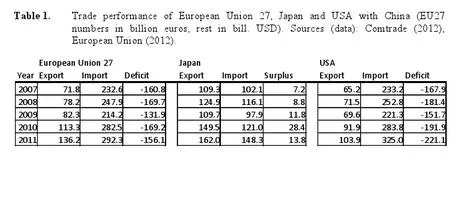

By Ioannis Lagouis, Olli-Pekka Hilmola and Albert Wee Kwan TanFor a long period of time, Yuan’s exchange rate has been on the agenda in the large trade deficit regions, such as the U.S.A. and Europe (see Table 1). The U.S.A. has been arguing for long time that China has kept currency valuations at artificially low levels, favoring Chinese manufacturing exports harming this way the manufacturing industry in the U.S.A.

In Europe the financial turmoil is also basically caused in parts due to lost manufacturing and lack of strong export industries (with the exception of Germany). As third member of the old power triangle (Ohmae, 1985), Japan, is also experiencing extremely difficult times due to its highly appreciated currency.

This has particularly hurt its export performance. However, Japan still manages to increase its exports’ competitiveness and during the last five years data show trade surpluses with China (Table 1).

From purely exchange rate perspective these arguments are more or less correct regarding to Europe and partially USA (Table 2). Comparing Chinese Yuan with European Euro and the Japanese Yen, it can be seen that there is hardly any change in the purchasing power between 2000 and 2012.

Table 2. Purchasing Power of the three world currencies compared to the Chinese Yuan (all years compared to 2000)

| YEAR | EUROPE | CHANGE | USA | CHANGE | JAPAN | CHANGE |

| 2000 | 8.39 | 8.28 | 0.081 | |||

| 2004 | 10.44 | 24% | 8.28 | 0% | 0.077 | -5% |

| 2009 | 9.05 | 8% | 6.82 | -18% | 0.075 | -8% |

| 2012 | 8.15 | -3% | 6.29 | -24% | 0.082 | 1% |

Source: Bank of Finland (2012) and Federal Reserve (2012)

Despite the European financial crisis, one Euro purchased three percent less in January 2012 compared to January 2000 and the same stands for Japan where a one percent change is reported.

So, the European Union’s perspective that that emerging and greatly trade surplus driven Chinese economy is not doing much to appreciate its currency has some substance. This could eventually hurt Asian export countries severely too as significantly lower consumption lowers foreign import demand.

With expected lower overall consumption levels in the future will make Europe less attractive and powerful, which will make lower Euro exchange rates in the future.

However, it should be emphasized that Asian countries in general, as taken into account level of GDP per capita, are performing well in international logistics indexes.

In fact, China is superior in this together with Malaysia, India and Thailand (Hilmola, 2011). Requirement level will increase considerably as Asian currencies will gain strength in the future and GDPs will increase correspondingly to catch hardly at all growing USA and Europe.

This means that the entire Asia should set its benchmarks to the best performing, like Hong Kong and Singapore in the region, but also in some transportation modes (like air transports and in parts to intermodal solutions) to the USA and Europe.

Advertise

Advertise