Retail Banking

Feeble asset quality, credit growth squeeze big Aussie banks

The full impact of the pandemic is yet to materialise.

Feeble asset quality, credit growth squeeze big Aussie banks

The full impact of the pandemic is yet to materialise.

Trials reflect weak economic ground for Cambodian banks

Wide credit-to-GDP elevate risks linked to economic imbalances.

CIMB sees H1 net profit drop to $189m

Elevated loan provisions triggered the fall.

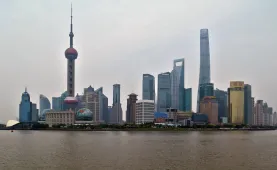

Chinese banks with more shrewd NPLs see slim earnings hike

But banks are still likely to slash dividends.

Maybank's Q2 profit sinks more than half to $225.95m

Impairment allowances surged to $417m.

Huge capital gap hounds China's big banks

The gap could expand up to $943b by 2024.

Weekly Global News Wrap: JPMorgan to pay $1b for China fund JV; Credit Suisse mulls job cuts

And Australia's BNPL firm Afterpay to acquire Spain's Pagantis.

APAC banks face varying effects of ultra-low rates

Typical challenges include weak interest income and NIM compression.

Indonesia's Bank Mandiri face lower margins, climbing NPLs

The lender’s net interest margin contracted by 65 bp in H1 2020.

Chinese banks' liquidity still enough despite key metrics slumping

Asset quality grew 10.8% in Q2 from 9.4% a year earlier.

MUFG to pool funds for pandemic-hit firms

It will issue sustainable bonds totalling $1.42b.

Chinese banks face first H1 profit drop in a decade

The regulator has urged banks to recognise bad loans and hike buffers.

Economic shock to hurt India's public sector banks

The government will be the likely source for recapitalisation.

Bank of East Asia posts 53.2% profit jump to HK$1.5b

Lower impairment losses in Mainland China caused the surge.

Virtual banks unlikely to threaten incumbent ASEAN banks: Fitch

Their digital edge, branchless model, and cost-efficiency plans give little edge against established lenders.

ANZ Bank adds $500m to provisions in Q3

This adds to the earlier $1.21b provision.

Pandemic disrupts digital banks' momentum in Asia

Their target markets have been severely hit by the pandemic.

Advertise

Advertise