Malaysian banks remain flush with liquidity in January

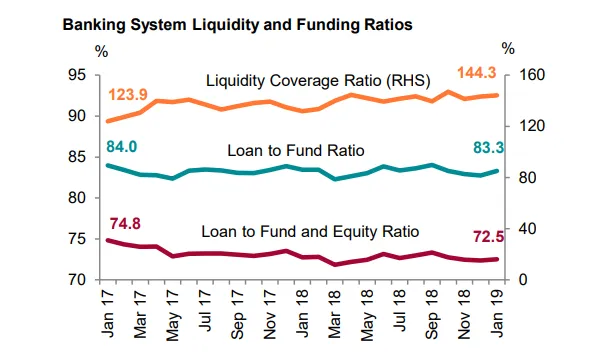

Liquidity coverage ratio stood at 144.3% which is above the required 100%.

Malaysian lenders remain flush with liquidity to weather external shocks as the liquidity coverage ratio (LCR) hit 144.3% with all banks sowing LCR levels above 100%, according to a report from the central bank. As of 1 January 2019, the minimum LCR requirement was set at 100%.

Also read: 1MDB scandal fails to shake trust in Malaysian banks: survey

The funding profile of banks was broadly stable, as the loan to fund ratio and the loan to fund and equity ratio stood at 83.3% and 72.5%, respectively, Bank Negara Malaysia said in its monthly report.

Bank Negara Malaysia (BNM)also noted that that net financing rose 5.9% YoY in January from 6.3% YoY in December.

On the other hand, the growth in outstanding business loans eased to 4.8% in January from 5.4% in December. Said loans were disbursed mainly to the construction, finance, insurance and business services, and real estate sectors. Meanwhile, growth in outstanding household loans eased slightly to 5.5% from 5.6% in December.

Chart from BNM.

Advertise

Advertise