DBS launches multi family office platform

The bank is already in talks with over 20 clients and prospects across Asia.

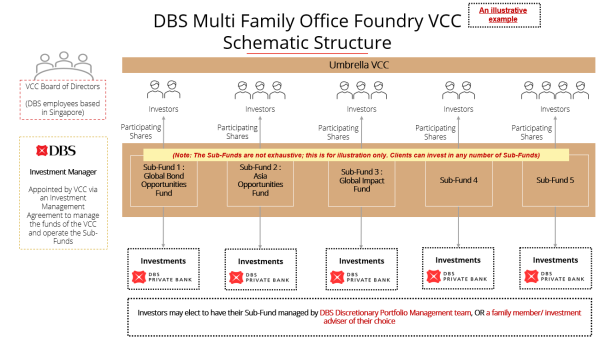

DBS Private Bank has launched the DBS Multi Family Office Foundry VCC (DBS MFO), offering investment and wealth services in a single platform without the need for clients to set up their single family offices in Singapore.

DBS MFO is an umbrella VCC with multiple underlying sub-funds. Clients may access a range of investment strategies and can choose either to have their subfund professionally managed by the DBS Discretionary Portfolio Management or DPM team, or by a family member or investment adviser of their choice, the bank said in a press release.

The new offering has reportedly attracted keen interest from ultra-high net worth families and their advisors globally, said Lee Woon Shiu, group head of wealth planning, family office & insurance solutions for DBS.

Shiu shared that the bank is already in talks with over 20 clients and prospects across Asia since previewing DBS MFO a few weeks earlier.

“Client interest in succession planning and wealth preservation has intensified and, in fact, we recorded a substantial increase in the number of new requests in [the first quarter]. This will continue to fuel the growth of our family office business,” Lee added.

ALSO READ: MAS to set expectations on credible transition planning

DBS MFO also offers tax exemptions on specified income derived from designated investments; a ‘lower’ barrier of entry for some clients who are not yet ready to set up an SFO; and cost savings, thanks to shared resources and expenses across multiple sub-funds, the bank said in a press release.

In the long-term, DBS plans to maximise the DBS MFO’s potential by “further developing innovative and sustainable long-term wealth structuring solutions to help UHNW clients navigate the complexities of the evolving legal and regulatory landscape in which they operate,” the bank said in a statement.

DBS said that it banks more than a third of the 700 SFOs established in Singapore, and that its Family Office AUM had also more than doubled in the last two years.

Advertise

Advertise