How did Japan's banks survive without passing on negative rates?

Despite tight margins, Japanese banks have higher survival chances than European banks.

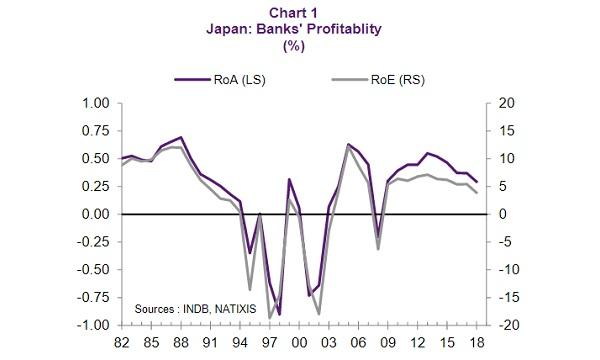

Even though they belong to Asia’s second biggest economy, Japanese banks are lagging their US and European counterparts in terms of profitability. With the Bank of Japan hinting that it is willing to cut the ultra-low interest rates further, local financial institutions face the reality of even tighter margins in the long-term.

Despite this, banks have managed to avoid passing the negative interest rate to their clients by expanding internationally and by leveraging government support, said Natixis Asia Research.

Japanese banks not only rapidly increased commission fees from their clients by selling mutual funds, but they also expanded their international operations. The share of overseas loans more than doubled from 1% in 2000 to 2.5% in 2019. When these institutions were hit with rising USD funding costs—especially after the US implemented the MMF reform in October 2016—they purchased US regional banks to lower the overseas loan to deposit ratio.

The country’s financial institutions have also steadily increased their exposure to the overseas portfolio and interbank lending to diversify their investment books.

Also read: Can going overseas salvage struggling Japanese banks?

These financial institutions also took advantage of the government’s deregulation measures.

Furthermore, Japan’s negative interest rate policy has been relatively supportive of banks, noted Natixis.

“The Bank of Japan (BoJ) introduced the negative rate of -0.1% later than the European Central Bank (ECB), whilst the ECB’s deposit facility rate was cut deeper to -0.5%. Through the central bank’s tiering system, the negative rate was applied to only 5% of the BoJ’s reserves, whilst 55% of the liquidity deposited at ECB were subject to the negative rate,” the report stated.

Also read: Japanese regional banks assume more risk to boost bottomline

The country’s softer banking regulation also played to the local banks’ interests. Japan’s banking regulations are generally softer than those imposed on European, thus offering them more space to manoeuvre.

All banks in Europe are in principle required to comply with the Basel III regulation of a capital ratio of at least 8%. On the other hand, domestic banks in Japan only need to meet a minimum core capital of 4%.

Advertise

Advertise