Lending & Credit

SG incumbent banks unlikely to take hit from neobanks' deposit cap raise: Fitch

Digital banks could face challenges beyond funding.

SG incumbent banks unlikely to take hit from neobanks' deposit cap raise: Fitch

Digital banks could face challenges beyond funding.

SMBC grants $50m green loan to Thailand's Indorama Ventures

Indorama Ventures will use it for their working capital and to achieve its sustainability targets.

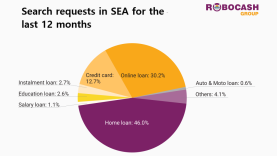

Housing loans, online loans most popular in SEA: study

Analysts said the rise in home loans is likely caused by the region’s geolocation.

HSBC builds up China green finance team: report

It also mulls offering carbon offset products to customers, a source said.

South Korea’s household loans rise 3.5% in June

Demand for bogeumjari loans and jeonse loans drive mortgage loan demand.

Sri Lanka’s NBFIs safe from risks after proposed gov’t debt restructuring plan

The plan does not directly impact the government debt holdings that NBFIs have stocked up on.

How Mocasa is supercharging the Philippines' credit payments market

The credit payment service company is also developing a data-driven central credit bureau.

Standard Chartered names ex-Credit Suisse banker as new sustainability strategy head

Barsky was previously global head of sustainable finance at Credit Suisse.

Vietnam’s HDBank sets up Korea desk

It will provide Korean corporates with specialized banking products and services.

Nearly 9 in 10 SEA people now have access to credit

The report delves deeper into the effects of credit access on financial services provider (FSP) customers.

Aggressive loan growth leaves HDBank more vulnerable to risks

Its asset quality may be further strained by its planned acquisition of a ‘weak’ bank

Australian banks face elevated risk of credit losses: S&P

Whilst losses are projected to remain low, a sudden price drop in the housing market spell trouble for banks.

Deposit war squeezes Malaysian banks’ margins

There is a steady outflow of savings deposits into higher-yielding fixed deposits, says S&P.

Bad loans of South Korean banks rose in April

Business loans classified as SBLs fell slightly.

Indian banks’ profits to stabilize; weak assets to persist for some

Weak assets are expected to make up 5.2% of gross loans for FY2023.

Delinquency rate of Korean corporate loans fell to 0.41%

Delinquency rate of household loans also fell to 0.31% in March.

Bad loans of Korean banks fell to 0.33% in March

The volume of resolved loans rose during the month.

Advertise

Advertise