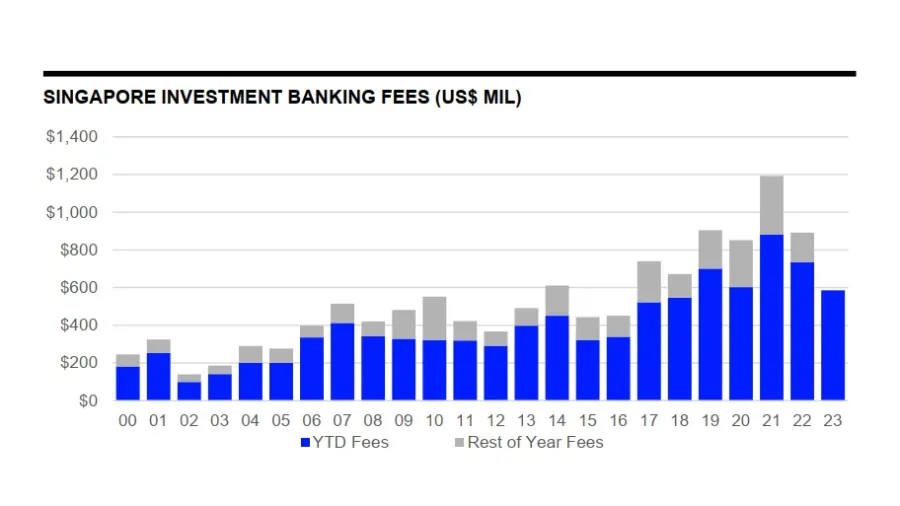

Singapore’s investment banking fees decline on fewer M&As

Banks also recorded lower DCM fees compared to the first nine months of 2022.

Banks in Singapore generated an estimated US$585.2m worth of investment banking fees in the first nine months of 2023, 20% lower compared to the same period in 2022, according to latest data from Refinitiv.

Advisory fees from completed mergers and acquisitions (M&As) notably fell by 32%, to just US$183.6m.

Equity capital markets (ECM) underwriting fees total US$122.9m, 7% more than the value recorded during the first nine months of 2022.

ALSO READ: Tech and transformation take center stage at the ABF Summit 2023

Debt capital markets (DCM) fees fell 35% to US$69.7m.

Syndicated lending fees declined 13% to US$209.1m so far during the first nine months of 2023.

Amongst banks, DBS is currently leading in Singapore’s investment banking fee league table so far, with a total of US$73.6m in fees. This is 13% of the total fee pool, Refinitiv said.

Advertise

Advertise