Private real estate investors target small-sized deals in Hong Kong

Two-thirds of total turnover are small deals.

Real estate investment in Hong Kong was mainly driven by private investors, and nearly two-thirds of the total investment turnover was contributed by small-sized deals, according to CBRE’s Asia Pacific Investment Guide 2015.

In 2014, Hong Kong recorded a total investment turnover of US$10 billion. Deals under US$100 million accounted for 63% of the total investment turnover, while big-ticket deals of over US$250 million only had a 14% share.

Here's more from CBRE:

In terms of investor type, private investors are dominating the real estate transactions, taking up 61% of the total investment turnover, followed by corporations (16%) and property companies (9%).

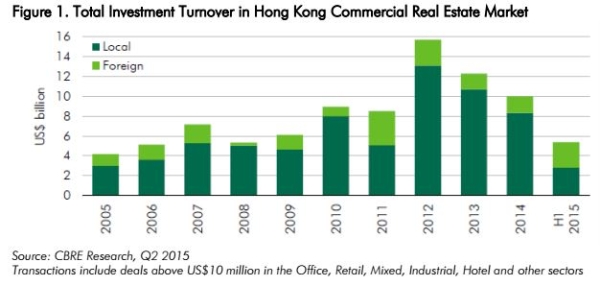

Data from CBRE Research reveals that the annual investment turnover has seen a gradual downward trend from the highest point of US$15.69 billion in 2012. The total turnover in the first half of 2015 amounted to US$5.37 billion.

With regards to the type of assets, strata-titled offices and factory buildings in decentralized

areas with the potential to be revitalized are more popular to investors. According to the Hong Kong New Directions in Office Property report jointly published by CBRE and Daiwa in May 2015, mainland China finance companies are becoming increasingly active in seeking office space in Hong Kong. Meanwhile, investment value of industrial properties have also been on the rise since the implementation of the industrial buildings revitalization scheme in 2010.

Advertise

Advertise