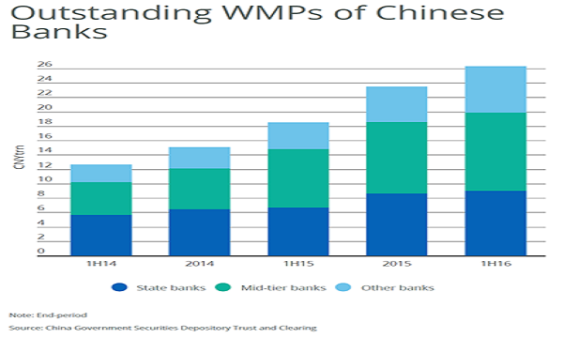

Chart of the Week: Growth of China's wealth management products at its slowest in two years

It reached USD3.9tr or 17% of system deposits in 1H16.

Wealth management products (WMPs) issued by Chinese banks remain a key source of credit and liquidity risk for smaller financial institutions, despite slower growth in 1H16, says Fitch Ratings. Mid-tier institutions' increased reliance on WMPs for funding makes them especially vulnerable, especially as loss events rise.

Here's more from Fitch Ratings:

Recently released data showed the outstanding balance of WMPs increased at the slowest pace in at least two years in 1H16, reaching CNY26.3trn (USD3.9trn) or 17% of system deposits. The Chinese authorities have been looking to tighten regulations on WMPs since late 2014, and in July 2016 circulated rules aimed at reining in the worst excesses.

Under the new regulations banks will need to set aside provisions for investment products until the risk reserve buffer reaches 1% of the banks' outstanding WMPs, while restrictions will also be placed on the investment scope for WMPs issued by smaller or less experienced banks.

These measures, if implemented successfully, would be credit positive. However, Fitch does not expect the changes to dramatically slow WMP issuance. Restrictions on lending to unsupported sectors and capital constraints mean that there are still incentives for banks to issue WMPs to increase their fee income and to invest in WMPs to boost overall asset yields. Market participants have also proved innovative at working around new regulations in the past.

Moreover, even with slower WMP growth, smaller banks are becoming more reliant on WMPs. We estimate that among mid-tier banks, for example, WMPs were equivalent to 43% of deposits at end-1H16, up from 41% six months earlier and just 22% at end-1H14.

WMPs may pose credit risks to banks, especially since money invested in them has not only gone to traditional asset classes, but has also been channelled increasingly into equity markets and forms of mezzanine financing. More than three-quarters of WMPs resided off-balance sheet at end-1H16 and, legally, it is the investors that are on the hook for any failed products; but in practice banks face reputational risks over WMPs, and very few WMPs ever report a loss.

An average of 3,700 WMPs were issued per week in 1H16, but only one issued by a domestic bank reported a loss over that period. In contrast, there were 67 losses reported among WMPs issued by foreign banks, despite foreign banks having a much smaller share of the WMP market and lower WMP yields compared to domestic banks. This compares to 44 and 51 losses reported in 2015 and 2014 , and may point to increasing stress in the WMP market. Banks could be forced to draw on their on-balance sheet loss-absorption buffers to bail out troubled WMPs in the case of significant stress.

WMPs also represent a key source of liquidity risk, given that the duration of WMPs is typically very short. The value of WMPs issued during 1H16 was CNY84trn, more than three times the outstanding balance at end 1H16, illustrating their high churn rates. Liquidity risks are heightened by the fact that banks have increasingly been investing in WMPs themselves. At end-1H16, 15% of bank-issued WMPs were held by other banks, up from 3% at end-2014.

Not only are China's mid-tier banks the most reliant on WMPs, they also have weaker loss-absorption capacity and thinner liquidity profiles than the state banks. The Viability Ratings (VRs) of China's 10 mid-tier banks range from 'bb-' to 'b', but we have warned that downgrades of their VRs could be triggered if WMP growth is not managed prudently and accompanied by a build-up of additional buffers.

Advertise

Advertise