Cyber risk outshines industry threats, surpassing natural disasters

As more firms store data, they become more vulnerable to attacks.

Cyber risk is now considered the most significant threat to the insurance industry, surpassing natural catastrophes and political risks, according to industry insiders.

“The fallout for businesses can be particularly severe. Within the EU, GDPR (passed in 2016) has resulted in large fines for businesses that fall victim to cyberattacks. The reputational damage on top of that is also extremely costly, as customers will not use businesses they do not trust,” Ben Carey-Evans, Senior Insurance Analyst at GlobalData, said in a media release.

Post-COVID-19, the rise in cyberattacks has intensified pressure on insurers to enhance proactive risk management and advocate for robust cyber protection strategies, said GlobalData.

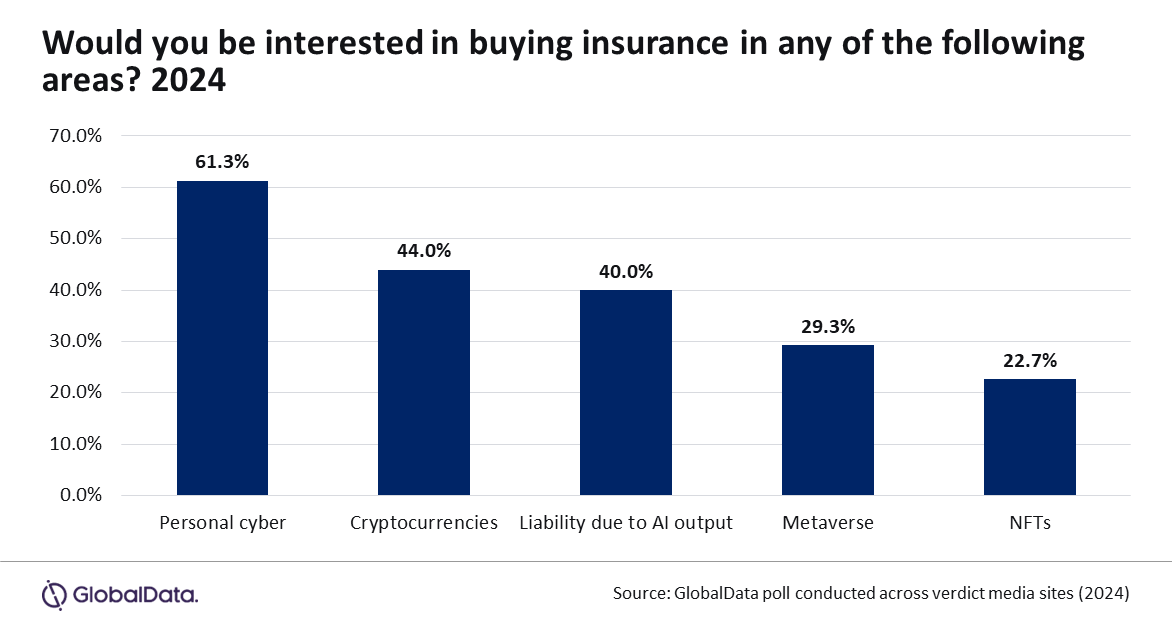

A poll conducted by GlobalData revealed that over a third of respondents expect cyber risk to be the leading threat over the next three years.

As companies worldwide store increasing amounts of personal data, they become more vulnerable to attacks. This underscores the importance of prevention.

Insurers must go beyond traditional policies, focusing on proactive risk management, including monitoring and training, to safeguard businesses from cyber threats.

While macroeconomic and supply chain issues are currently affecting pricing, experts believe these challenges will subside.

“Cyber presents a vast threat but also an opportunity for insurers. It is a very difficult line to price and make affordable, which increases the challenge for insurers and deters many businesses from purchasing it. Insurers will need to convince businesses they can protect them against the ever-increasing level of cyber threat and therefore become an essential part of their day-to-day operations,” Carey-Evans added.

Advertise

Advertise