Insurers, employers key to mental health access: GlobalData

Vietnamese consumers showed the most concern for their mental well-being.

Levels of mental well-being have been identified globally, with 73.1% of consumers worldwide ranking mental well-being as their top concern.

Stress and anxiety are particularly significant issues, often hindered by stigma, which limits open discussion and accurate reporting, according to GlobalData's survey

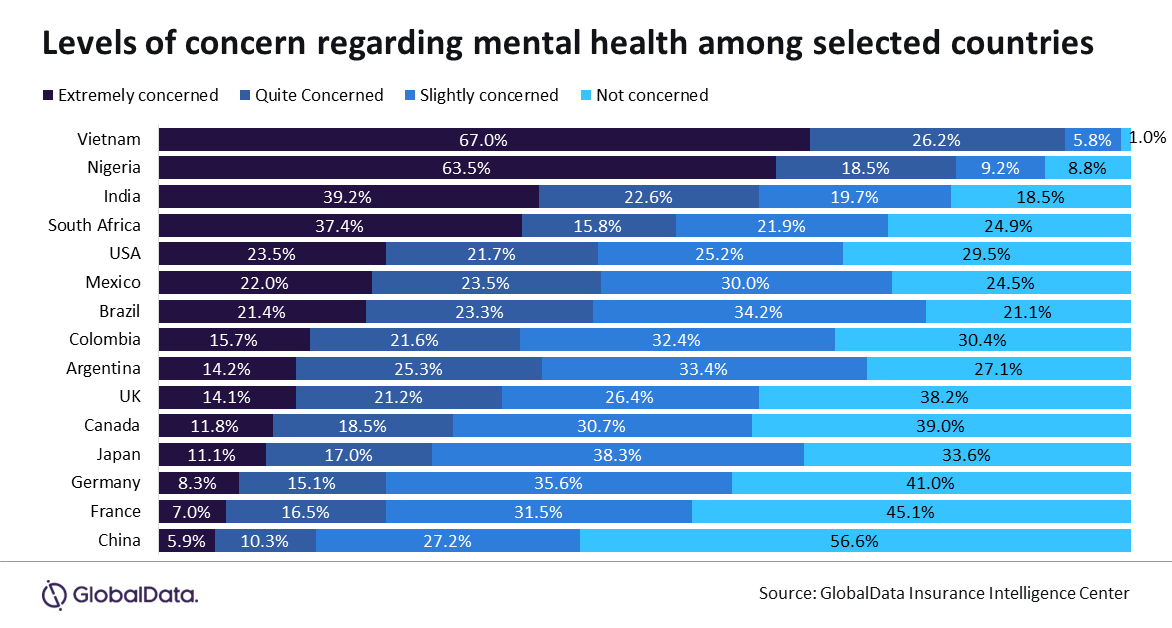

Vietnam and Nigeria stand out as the most concerned nations, with 99% and 91.2% of consumers expressing worry about their mental health, respectively.

Societal pressures, economic instability, and limited access to mental health resources contribute to these heightened levels of concern.

Guillaume Anns, an Insurance Analyst at GlobalData, emphasises the urgent need for global initiatives to prioritise mental health.

He underscored the role of insurers, employers, and governments in improving access to mental health services, raising awareness, and fostering supportive environments.

The report also notes an increase in employers prioritizing mental health and wellbeing initiatives, highlighting a shift towards supporting employees' overall health, financial security, and physical wellness.

However, GlobalData's 2023 SME Insurance Survey reveals a concerning trend where both employers and employees assign lower priority to soft support services like employee assistance programs and digital wellness tools, which are crucial for enhancing mental and emotional well-being.

“The survey findings underscore the critical need for increased focus on mental health and wellness initiatives globally, with insurers playing a pivotal role in supporting employers and individuals in addressing these concerns. By investing in mental health programs and fostering a supportive work environment, insurers and businesses will see the benefits. It will enhance employee wellbeing, productivity, and overall societal health within a business, and could result in fewer and less severe claims relating to mental health for insurers.” Anns concluded.

Advertise

Advertise