Insurance incentives sweeten EV deal for consumers

Tax incentives and the introduction of charging stations are boosting the EV market.

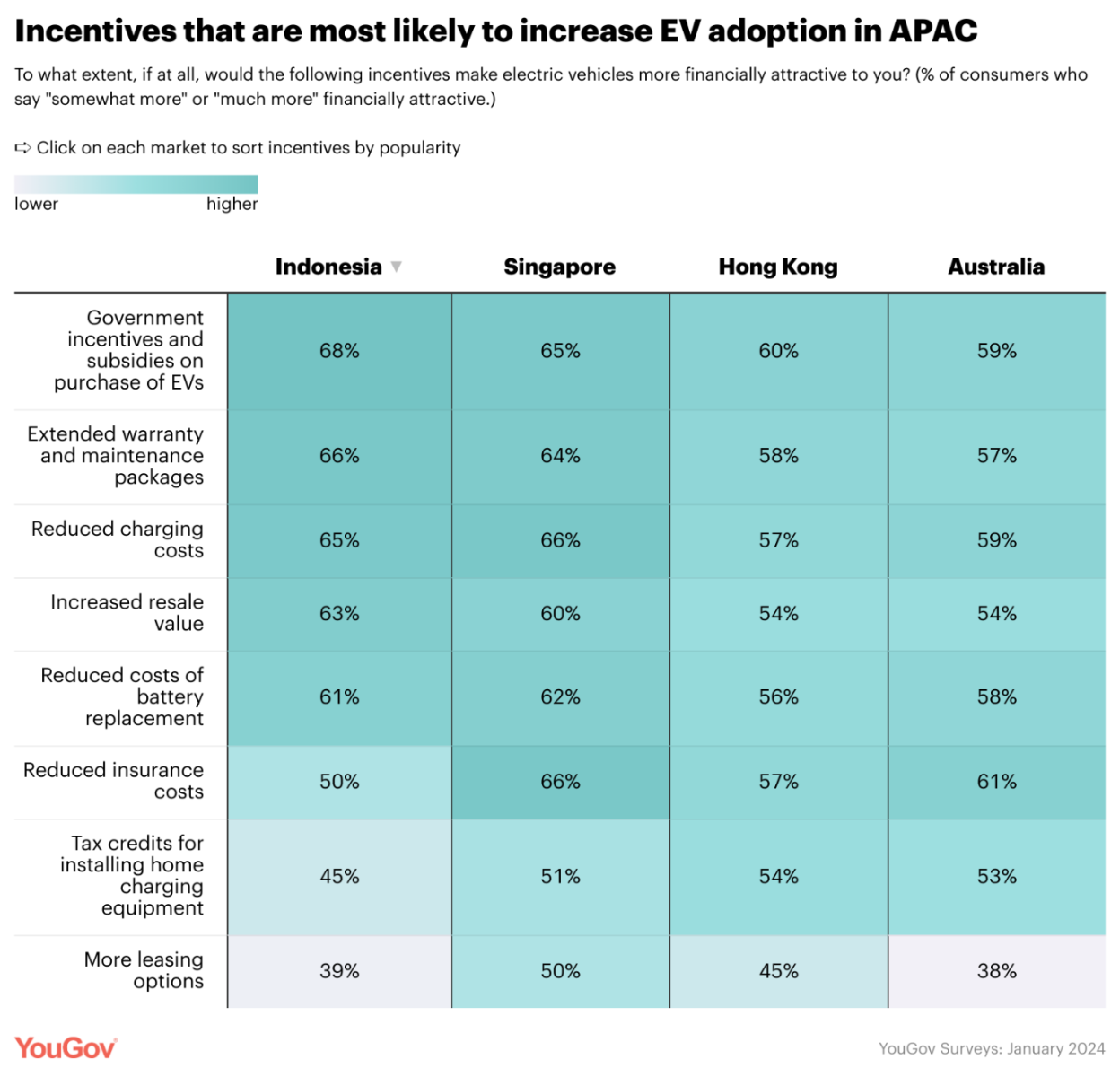

Lower charging and insurance expenses are expected to hasten the adoption of electric vehicles in Singapore and Hong Kong, whilst Indonesians prioritise government subsidies.

Recent developments across the Asia Pacific (APAC) region, including tax incentives and the introduction of new charging stations and car models, are bolstering the electric vehicle (EV) market. The latest YouGov Surveys research focuses on identifying the incentives that consumers in key APAC markets believe would make owning EVs more financially appealing.

In Indonesia, reducing upfront costs and operating expenses through government incentives and subsidies is the most effective way to encourage EV adoption, with 68% of respondents expressing this sentiment. Additionally, measures like extended warranty and maintenance packages (66%) and reduced charging costs (65%) are also highly desired by consumers.

ALSO READ: EV rise in Australia drives risk considerations and insurance hurdles

In Singapore, making EVs cheaper to maintain and purchase is paramount. Lower charging and insurance costs (both 66%) are particularly appealing, along with government incentives and subsidies (65%) and extended warranty and maintenance packages (64%).

Similarly, in Hong Kong, reducing upfront costs and operating expenses is crucial for EV adoption. Government incentives and subsidies (60%) and extended warranty and maintenance packages (58%) are seen as effective measures to make EVs more financially attractive.

The data is based on YouGov Surveys conducted online in January, with samples ranging from 510 to 2,044 adults aged 18+ in 17 markets.

Advertise

Advertise