Taiwan’s life insurance sector will bounce back in 2024 – GlobalData

The industry is forecast to grow at a compound annual growth rate (CAGR) of 3.0% to $91.6b in 2027.

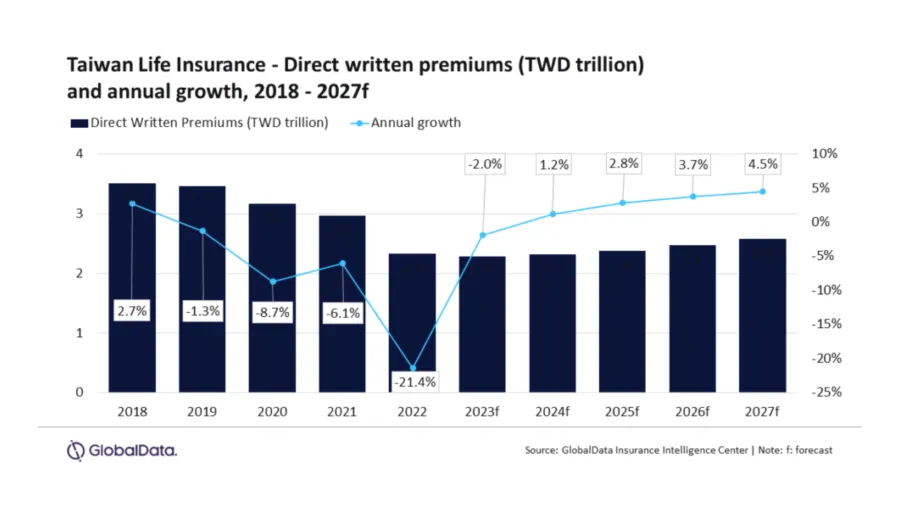

Taiwan's life insurance market is poised for a turnaround from 2024 after facing a continuous decline since 2019. This positive shift is expected to be driven by improvements in the global macro-economic situation, rising interest rates, and positive regulatory developments, according to GlobalData.

While Taiwan's life insurance market is projected to decline by 2% in 2023 due to factors like prolonged low-interest rates and lack of innovation in product offerings, the industry is forecast to grow at a compound annual growth rate (CAGR) of 3.0% from $77.7b in 2023 to $91.6b in 2027, in terms of direct written premiums (DWP).

Anurag Baliarsingh, Insurance Analyst at GlobalData, noted that the decline in 2022 was unprecedented, with a 21.4% drop attributed to uncertain market conditions affecting renewals.

The appreciation of the US dollar led to a 32% decline in premiums from foreign-currency-denominated life insurance policies, representing 46.7% of new business in 2022.

Term life insurance, accounting for a 45.4% share of Taiwan's life insurance DWP in 2022, is expected to grow at a CAGR of 3.4% over 2023-2027.

ALSO READ: Recent regulatory changes to boost Taiwan’s life insurance sector: Fitch Ratings

Positive regulatory developments, such as proposals to allow neo-insurers to sell online term insurance, are expected to support term life insurance sales.

Endowment insurance, with a 21.6% share of life insurance DWP in 2022, is anticipated to grow at a CAGR of 2.3% over 2023-2027.

The demand for endowment insurance products is supported by their higher returns compared to other life insurance products, particularly amidst high inflation impacting disposable income.

Personal Accident and Health (PA&H) insurance, the third-largest product with a 20.9% share of DWP in 2022, is expected to grow at a CAGR of 3.3% during 2023-27.

PA&H insurance growth is supported by demographic factors, including a super-aging society and high life expectancy in Taiwan.

General annuity and other life insurance products collectively accounted for the remaining 11.7% share of DWP in 2022.

Despite the forecasted recovery from 2024 onwards, Taiwan's life insurance industry is not expected to reach its previous levels of growth in the near term.

Advertise

Advertise