Nearly 2 in 5 of SEA’s L&H premiums now from bancassurance: Swiss Re

But many customers don’t trust bank sales representatives as much, the study found.

Bancassurance now accounts for an average of 36% of all life and health (L&H) insurance premiums across six Southeast Asian markets, according to the latest findings by reinsurance company Swiss Re.

Approximately 1 in 2 (52%) of consumers from the six markets– Singapore, Thailand, Vietnam, Indonesia, Malaysia, and the Philippines–preferred buying savings products from banks over agents, likely due to the similarity between insurers' and banks' offerings.

Singapore, Thailand, and Vietnam, however, still have a strong preference for insurance agents over banks, especially for medical and hospitalisation insurance.

New challenges

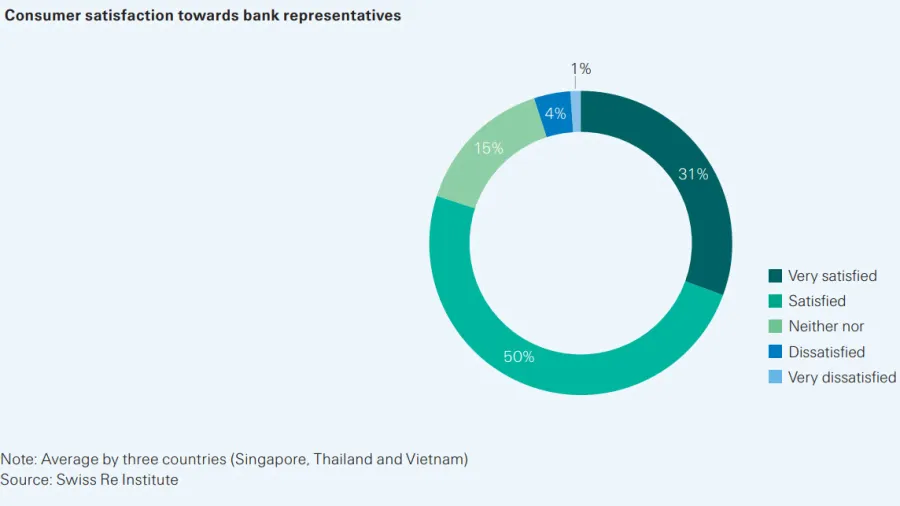

Whilst bancassurance is on the rise in SEA, the sector still faces a number of challenges, such as the decline to in-person visits to bank branches and customers’ dissatisfaction with sales representatives.

More than a third of consumers expressed concerns regarding banks, as sales representatives have weaker product knowledge and would recommend products that don’t suit their needs, Swiss Re found.

As a result, almost 7 in 10 (67%) of SEA consumers prefer agents for medical/ hospitalisation insurance, citing better product knowledge and service.

"For the continued success of bancassurance, it's crucial for insurers to support banks in deepening their understanding of insurance products,” said Daisy Ning, head of L&H reinsurance Asia Pacific excluding China, Swiss Re.

Bank sales representatives, meanwhile, are confident with their insurance product knowledge– with 89% of banks sales staff saying such. However, they indicated that they fund underwriting, as well as the complex and technical nature of the onboarding process as challenging when it comes to selling insurance.

Potential for growth

With bancassurance becoming more popular as a distribution channel, it is essential for insurers to enable banks to understand the evolving insurance landscape and adapt accordingly, says Swiss Re.

For example, consumers are still buying more savings-type insurance products through bancassurance than protection products, indicating an area for remediation.

“The evolving landscape, with rising interest rates and popularity of digital platforms, also calls for banks to explore more innovative strategies and partnerships, such as integrating AI solutions to guide customers or bundling insurance with other bank offerings,” noted Ning.

Advertise

Advertise