NZ climate disaster payouts reach NZ$2b

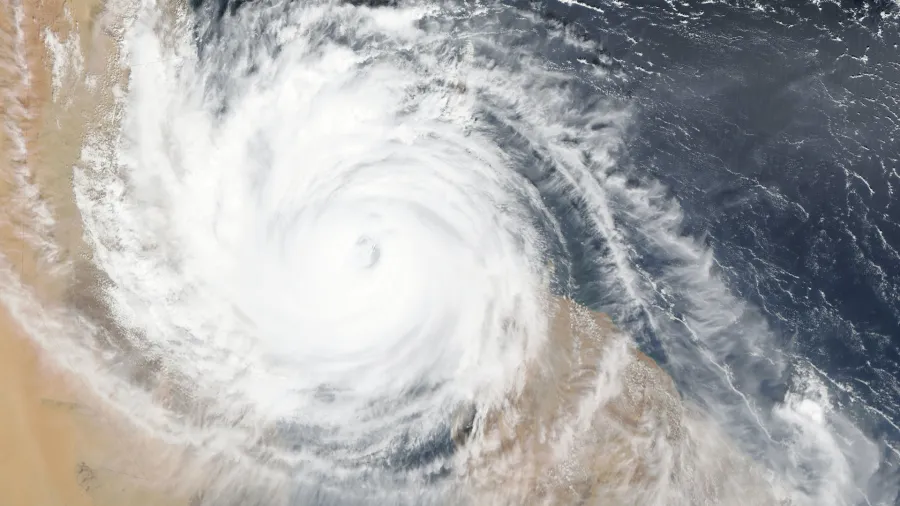

It is estimated that NZ$3.5b claims will be rooted in Auckland floods and cyclone Gabrielle.

New Zealand insurers have already paid out NZ$2.1b from an updated estimate of NZ$3.5b for general insurance claims related to the Auckland Anniversary Weekend floods and cyclone Gabrielle, according to the Insurance Council of New Zealand (ICNZ).

These claims encompass 112,812 reported cases.

Tim Grafton, Chief Executive of the ICNZ, acknowledged significant progress in settling claims, especially when compared to past large-scale disasters.

He emphasised insurers' commitment to supporting customers until all claims are resolved.

The estimated value of claims for the Auckland events now exceeds NZ$2b, while cyclone Gabrielle's claims in Hawke's Bay have surpassed NZ$1b.

As of 1 September, insurers have covered approximately 64% of claims by volume and around 59% by value. Settlements have been progressing as anticipated across various insurance categories.

ALSO READ: New Zealand's Veterinary Professional Insurance Society solvency to weaken: analyst

Notably, around 96% of motor claims and 84% of contents claims have been paid by value. Business claims, which are often more complex, have seen approximately 46% settlement, while house claims have fared better at 61% payout out of an estimated total of around NZ$1.6b for both events. However, there are still many complex and high-value claims awaiting resolution.

Insurers have gleaned valuable lessons from handling over a year's worth of claims in just 15 days earlier this year.

Despite the initial challenges, insurers quickly mobilised additional resources, some from overseas, and implemented long-term plans to address the influx of claims. This effort involved deploying hundreds of extra staff, said the ICNZ.

In addition to the Auckland Anniversary Weekend floods and cyclone Gabrielle, other extreme weather events in the North Island earlier in 2023 have resulted in a total of 119,435 climate-related claims worth approximately NZ$3.6b.

Advertise

Advertise