Singapore’s life insurance industry to be worth S$100.4b in 2027

Demand for whole life insurance has risen due to a pandemic-induced awareness.

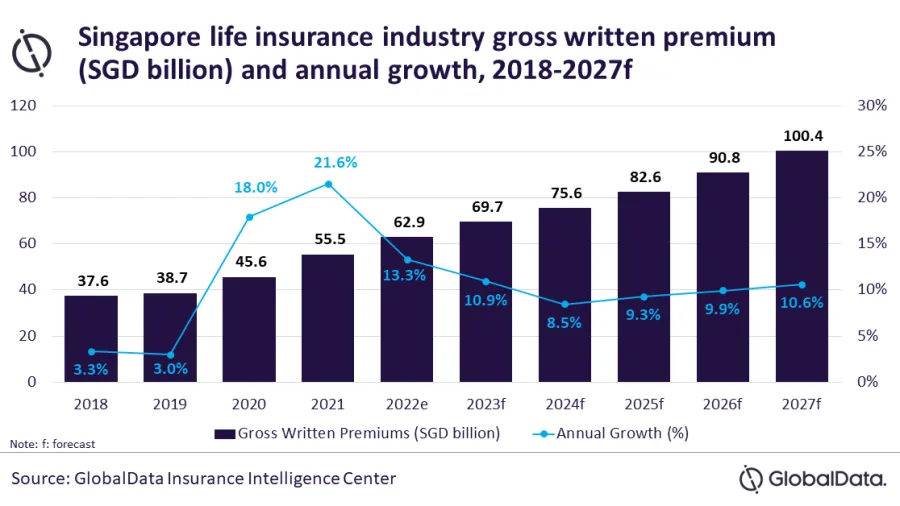

Singapore’s life insurance industry will grow to $77b (S$100.4b) in 2027 in terms of gross written premiums (GWP), according to data and analytics company GlobalData.

This represents a compound annual growth rate or CAGR of 9.8% between 2022 and 2027.

The Lion City’s life insurance industry grew 13.3% in 2022, and is projected to grow a further 10.9% in 2023. This is slightly slower than the 18% and 21.6% growth reported in 2020 and 2021.

“The industry growth is expected to slow down from 2022 onward due to slowing economic growth, rising inflation, and global geopolitical uncertainties,” said Shabbir Ansari, senior insurance analyst at GlobalData.

The growth will be driven by increased awareness of financial planning after the pandemic, which led to a rise in demand for protection products like term and whole life insurance, GlobalData said.

ALSO READ: Protection gap in Southeast Asia a massive opportunity for insurers: S&P

Whole life insurance, which is the largest segment within the country’s life insurance market at 50.3% of the GWP share in 2022, is expected to grow at a CAGR of 10% through 2027.

Demand for whole life insurance has risen due to the pandemic-induced awareness of the need for financial protection from life-threatening events and diseases.

Meanwhile, a large proportion of whole-life premiums in Singapore come from single premium policies, driven by the presence of a large affluent population. Ansari noted.

“Singapore has one of the largest concentrations of high net-worth individuals (HNWI). The share of single premium policies in the overall life insurance GWP has increased from 32.3% in 2019 to 49.7% in 2022,” Ansari said.

Endowment insurance made up 33.1% of the life GWP share; whilst personal accident and health (PA&H) accounted for 8.6% of premiums.

Term life as well as other life and annuity insurance accounted for the remaining 8% share of the life insurance GWP last year.

Advertise

Advertise