APAC outperforms as global insurance M&A hit 10-year high in 2022

A slowdown in M&A deals in H2 offset some regions' performance.

Global insurance mergers and acquisition (M&A) deals hit a 10-year high in 2022 with 449 M&A deals up 418 in the previous year, a report by global law firm Clyde & Co. revealed.

However, comparing the two halves of the year, H2 so a marked downturn with 207 deals completed compared to 242 in H1, as economic and inflationary pressures began to impact investor sentiment.

“Despite the return of inflation, and measures from central banks to restrict liquidity, deals that were put on hold during the pandemic continued to come to market in 2022, maintaining the upswing in deal-making that began the previous year,” Eva-Maria Barbosa, Chair of Clyde & Co's Corporate & Advisory Group, said

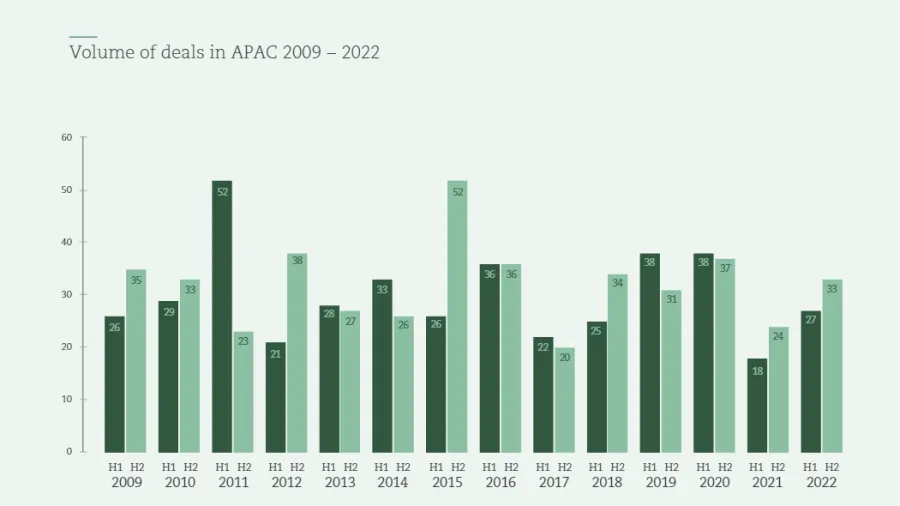

Out of all the regions, Asia Pacific logged the highest number of M&A deals in the insurance industry, increasing by 42.86% compared to 2021. The region also saw a 22% increase in M&A deals in H2 2022, the only region not to experience a dip in deals.

Barbosa said this may be because of mixed investor sentiment. Comparing Asia to other regions, the Americas and Europe displayed a heightened sense of caution, switching instead to a wait-and-see mode in the face of market uncertainty which resulted in a lag in overall transaction volume.

“In contrast, investors in Asia-Pacific were generally slower to regain confidence post-pandemic, but have put that reticence behind them with a consistent and increasing trend of rising deal numbers. The re-opening of China’s borders following lockdown restrictions will only serve to bolster confidence in the region further.”

The Americas remained the most active region for M&A in 2022, with 236 deals, up 5% in 2021. Deal volume in H1 2022 reached its highest level since 2011 with 132 deals but dropped 21% in the second half of the year to 104. Activity in the Middle East and Africa was up 41% year-on-year, propelled by a strong first half (16 deals) followed by just eight in H2 2022. Europe saw the smallest annual increase with 127 transactions in 2022, up from 125 the previous year, while H2 2022 marked the second consecutive period of declining activity in the region.

For 2023, M&A volume is expected to drop from the highs in 2022, only rebounding in the second half of the year, with larger deals in focus.

“Uncertainty continues to provide barriers to growth for the insurance sector, with significant headwinds coming out of the events of the last year. The war in Ukraine continues to complicate global trade and drive up costs, while some eye-opening weather events in 2022 that exceeded all loss expectations have confounded the property catastrophe (re)insurance market. However, there is optimism that the economy is set to emerge from this difficult period as inflation stabilises. When it does there remains plenty of capital to be deployed and likely no shortage of M&A targets. As investor sentiment improves, ambitious insurers, particularly at the top end of the market – as well as private equity houses – will move to seize these opportunities,” Barbosa said.

Advertise

Advertise