Asia commercial insurance pricing surge continues rate of decline

The increase which began in 2020, has slowed down significantly in 2021.

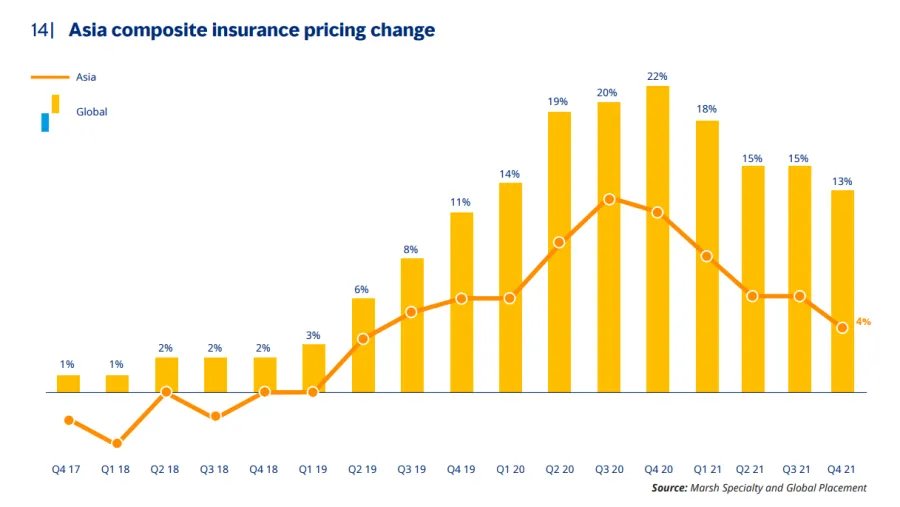

Commercial insurance pricing in the fourth quarter of 2021 in Asia increased 4% year-on-year (YoY), continuing a slowing of increases that began in the third quarter of 2020, according to the Global Insurance Market Index 2021 Q4 by global insurance broker Marsh.

Commercial insurance pricing rose by 6% YoY in Q2 and Q3 of 2021, down from 8% in Q1 2021 which also fell from the 11% increase in Q4 2020.

Segments

Property insurance saw an increase of 3% in Q4, down from 5% in the third quarter. According to Marsh, they saw elements of insurer competition returning, focusing on loss-free clients in low-hazard industries. The market was said to remain challenging for clients in catastrophe zones, high-hazard industries and those with poor loss histories.

Meanwhile, casualty insurance pricing increased 2% after three years of relatively flat pricing. Marsh said that clients with high claims frequency typically had more difficult placements whil;st capacity continued to be plentiful however multinational insurers had restricted capacity on excess layers, particularly with product recall and products liability exposures.

FInancial and professional lines remained stable, increasing by 17%, the same as in the third quarter. Marsh said that insurers in this segment focused on risk selection with directors and officers (D&O) liability insurance accounting for the significant portion of pricing increases. Cyber insurance, meanwhile, remains the most challenging coverage area driven by ransomware claims, with considerable pressure on pricing and deductibles, a reduction in

capacity, and narrowing of key coverages.

Pricing increase remains moderate

With the exception of cyber insurance, Marsh reported that global price increase moderated in 2021.

Global commercial insurance prices rose by 13% in Q4 2021, a decline of 15% in both second and third quarters. Global pricing increases peaked in the fourth quarter of 2020 at 22%, and slowed or remained flat throughout 2021.

Advertise

Advertise