Thai life insurers to suffer further decay this year

Premiums are likely to drop 1.6%.

Thailand’s life insurance industry, which has been sluggish since 2015, will decline further this year due to existing challenges aggravated by the pandemic, according to a GlobalData report.

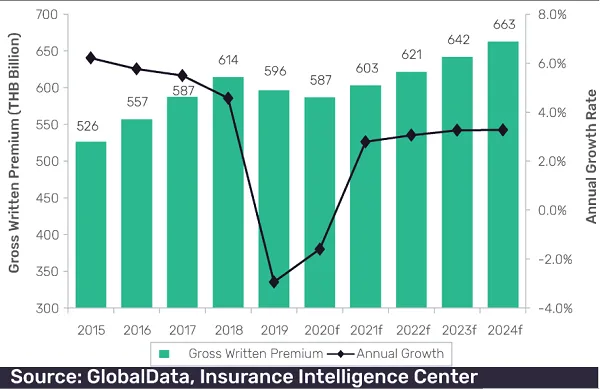

Insurance premiums are estimated to drop 1.6%, its second consecutive year. But the sector is likely to rebound from 2021 and will grow at a CAGR of 2.1% from 2019 to reach $21.9b (THB662.7b) in 2024.

“The downward revision in insurance prices due to the introduction of new mortality rates and the new regulatory framework, especially the implementation of IFRS 17 and 9, are set to further exacerbate the problems,” said GlobalData analyst Madhuri Pingali.

Insurers are adapting by prioritising sustainable growth and overhauling their product mix, the report noted, with many companies decreasing the share of policies with guaranteed return in favour of investment products where the insured assumes the investment risk.

Another focus is the digitisation of distribution, which offers relative cost advantage compared to the traditional distribution channels. Insurers currently rely on agency and bancassurance channels for more than 80% of the life insurance business, GlobalData said.

“The spike in the sale of COVID-19 insurance products in the last couple of months indicates that despite the immediate setback, the industry stands to benefit in the long-term due to increase in consumer awareness following the outbreak,” Pingali concluded.

Advertise

Advertise