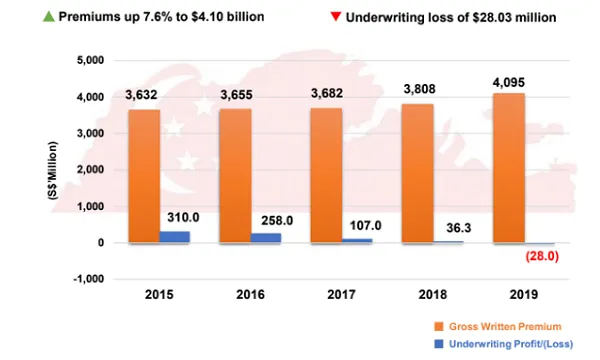

Singapore general insurance sector posts $28m underwriting loss for 2019

The top five segments accounted for a combined $43.4m underwriting loss.

Singapore’s general insurance sector posted an underwriting loss of $28m as the industry paid out 12.2% more or $159m in claims in 2019, according to the General Insurance Association of Singapore (GIA).

The sector recorded a 7.6% annual growth in gross written premiums to $4.1b in the same year.

The top five segments—motor, health, property, employer’s liability, and travel—accounted for a combined underwriting loss of $43.4m.The motor segment posted $1.12b in gross written premiums in 2019, a 1% increase from the previous year, with a 7.6% or $41.3m growth in total claims paid out. Overall underwriting loss came at $17.4m for the segment.

Last year saw a shift in vehicle ownership in Singapore with a spike in private-hire cars (PHCs). On the other hand, it meant that the sector was insuring a vehicle population with higher risk profiles as PHCs are more frequently driven on the road.

Meanwhile, the health insurance segment’s underwriting loss shrank to $11.2m in 2019, a 75% improvement from 2018’s $44.2m. Total claims pay-out for policyholders rose 8.1% or $22.6m whilst gross written premiums increased $666.8m.

Employers’ liability insurance segment recorded an 8.9% increase in gross written premiums, thanks to the continued growth of employment in the construction sector in 2019. Whilst the number of workplace fatalities fell to a record low last year, the sector paid $8.29m more in work injury compensation, reflecting the 5% growth in the number of non-fatal injuries.

The property insurance sector paid out 50% more or $24.3m in total claims with sustained growth in gross written premiums of $538.2m, albeit with an underwriting loss of $4m. This was brought about by an overall 7.8% increase in fire accidents particularly involving personal mobility devices.

Lastly, travel insurance’s gross written premiums rose 7.1% to $211.4m with an underwriting loss of $3.4m as total claims pay-out surged 20% to $65.1m. Personal accident insurance gross written premiums increased 2.6% to $176.8m, with an overall underwriting profit of $17.2m.

Advertise

Advertise