SGX FX futures trading volume hit $175.12b in January

USD/CNH and INR/USD futures both jumped.

The aggregate volume for Singapore Exchanges (SGX) FX futures rose 25.5% YoY to 2.4 million contracts in January, with its total volume jumping 20% YoY to $175.12b (US$126b) during the month, according to an SGX report. This is despite seeing global equity markets becoming largely flat as the coronavirus outbreak is offsetting gains.

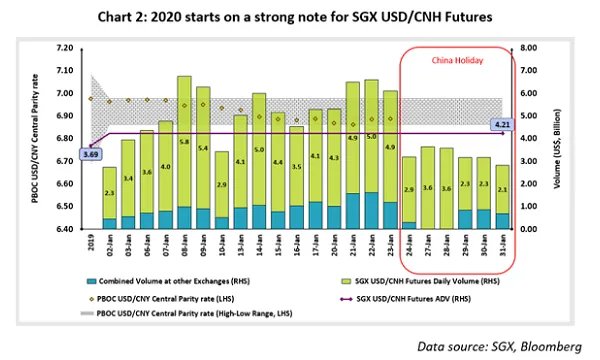

The SGX USD/CNH Futures volume went up 15% YoY to $117.16b (US$84.3b) in January as participants traded $117.15b (US$84.3b) at 84,271 contracts and remained above 80% of the global total Its month-end open interest climbed 18% MoM to $8.76b (US$6.3b).

Likewise, the average daily volume of SGX USD/CNH Futures rose to $5.85b (US$4.21b) as trading is said to have remained robust and exceeded $2.78b (US$2b) on all days during the month, despite public holidays and lack of guidance from onshore markets.

With recent developments potentially adding to the negative sentiment around the renminbi, open interest has grown as market participants looked to manage associated risk. Open interest in SGX USD/CNH Futures grew 20% MoM at 64,023 contracts, representing nearly 71% of the open interest across all exchanges with similar offerings.

Meanwhile, SGX INR/USD futures jumped 29% YoY at $5.7b (US$41b) in January, with volume exceeding 1.4 million contracts, despite stagflation worries and civil protests sour sentiment.

Advertise

Advertise