How Lendela streamlines customers' loan application process

The platform matches up customers’ loan needs from banks and lenders.

Taking out a loan can be a daunting process for customers. Inquiring across different banks and lenders already takes up days of surfing the net, hours of calls, and waiting at your local lender branch. Then there comes the repetitive process of filling out application forms, waiting for your loan to be processed—all the while possibly not knowing that a better deal is just around the corner.

This was exactly what Nima Karimi, founder and CEO of Singapore-based loan matching platform Lendela, found when he first encountered the lending environment in Asia’s two biggest financial centers.

“Having worked at Scandinavia’s two largest loan platforms, I was surprised by the lack of any borrower-friendly platform in Singapore and Hong Kong. The high interest rates, a tedious process of applying for a loan and an overall lack of transparency made many borrowers turn to unlicensed money lenders or ‘loan sharks’,” he told Asian Banking & Finance in an interview.

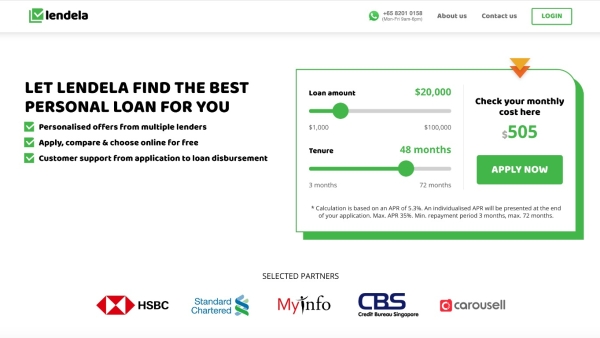

Using his experience from working at two of Scandinavia’s largest loan platforms, Karimi moved full-time to Singapore in 2018 and founded Lendela. The online platform matches up the customer to various lending offers of banks and other licensed lenders in just a few clicks. Customers need only to fill out one online application form, which was then made available to Lendela’s partner banks and lenders where the applicant qualifies to apply.

“Within 24 hours, the applicant will be presented with multiple offers and can immediately make a choice and proceed to sign the final loan documents,” added Karimi.

Their partners include leading banks such as Standard Chartered and HSBC, as well as well-established licensed moneylenders like Accredit, IFS Capital and Minterest, amongst its partners.

The platform is 100% free-of-charge for customers. Lendela gets a service fee once the borrower accepts an application using the platform.

Since launching in 2018, Lendela has processed more than 10,000 loans applications in Singapore and Hong Kong. The platform plans to expand its market over the next few months, with an announcement coming by the end of the year.

Lendela also plans to add-on to its customer identification services, as well as provide alternative and ‘actual’ credit scoring in the platform itself, whilst continuing to speed up and digitise the loan application process.

Reducing costs

Karimi noted that with the need for loans often increases during challenging times such as the ongoing economic crisis afflicting the region, and that Lendela can play a large part in bridging the demand.

“We believe Lendela can play a large part in providing borrowers with more choices, whilst significantly reducing administrative cost and saving time for the financial institutions. Lendela’s 100% digital process leading up to the final signing of the loan documents is even more valuable in a pandemic like COVID-19 with restrictions on social interaction,” he said.

He shared that the biggest challenges in the lending space are the lenders’ lack of transparency and simplicity in their loan process, as well as their slow adoption of a 100% digital application procedure. For example, there is still a lack of acceptance of digital signatures, which inhibits a 100% digital application for platforms by Lendela—the final signing still needs to be done offline.

Karimi added that fintech companies should have access to credit reports, which in turn will help them explain to their customers what their credit situation is. “The fact that fintech companies such as Lendela are not able to acquire credit reports makes it more difficult to help borrowers understand their credit situation.”

“Also, a lack of effective ways to stop unsolicited marketing by lenders seems to foster illegal advertising and lending which in the end hurts the consumer,” he concluded.

Advertise

Advertise