Here's where alternative lending thrives in Asia

The land of GoPay and OVO is no man’s land for banks.

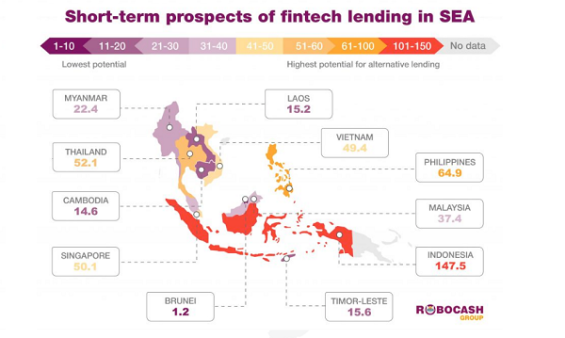

Where alternative lending thrives, banks have reason to fear, especially in Indonesia, which ranked as the most fertile environment for the development of alternative lending platforms, according to a survey from Robocash.

With a score of 147.5, Indonesia ranked highly in sixteen different aspects used by the study associated with social and economic development, financial inclusion and digital adoption.

In 2017, only 48.9% of the Indonesian had a bank account, but 54.8% borrowed money, according to Robocash. This could be attributed to strong demand from low and middle-income borrowers that are attracted to the low borrowing costs and less stringent requirements offered by alternative platforms than traditional banking set-ups.

Also read: 7 in 10 Indonesian banks threatened by ride-hailing firm Go-Jek

E-money transactions in Indonesia hit $3.3b (IDR47.2t) in 2018 with as many as 173.8 million digital money instruments issued in January 2019, data from Fitch Solutions show. There are 64 operational P2P lenders in Indonesia as of June 2018 although reports suggest that there as many 99 legal entities registered with the central bank.

“The most significant factors placing Indonesia to the top are the population size, widespread use of mobile phones, growing need for finance with remaining low access to financial services,” the firm said in a report.

Taking second place is the Philippines (64.9) which also acts as a strong breeding ground for fintechs given its significant and mobile-first population with Filipinos ranking first in the world for the time spent online and on social media. Only 34.5% also have a bank account in 2017 which represents a large opportunity to tap the population. “The fact of borrowing amongst 58.6% of people in 2017 confirmed the gap between the real demand for finance and financial inclusion,” Robocash added.

Also read: Philippine banks boost tech in push for financial inclusion

Thailand ranks third with an index score of 52.1 with a population that feels at ease with the Internet. Robocash noted that 82% of the country’s population are Internet users in 2018 and 62.3% made or received digital payments in 2017. Singapore and Vietnam round out the top five with an index score of 50.1 and 49.4.

In the background of the apparent leaders, Robocash noted that the rest of Southeast Asia may seem less attractive for fintech lending with Myanmar (22.4), Laos (15.2) and Cambodia (14.6) that look promising in a longer-term perspective.

Advertise

Advertise