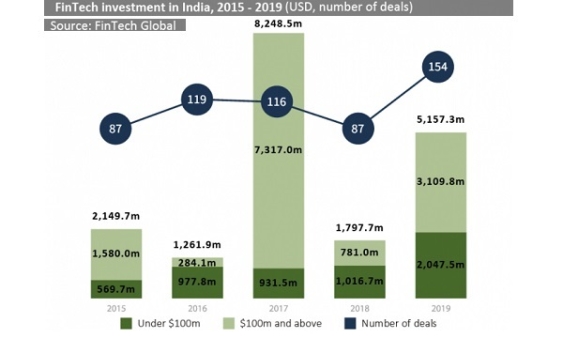

Chart of the Week: India's fintech investments grew 19.1% in 2015-2019

In 2019, local firms raised $5.1b in total from 154 deals.

India’s fintech sector saw its investments grow at a compound annual growth rate (CAGR) of 19.1% from 2015 to 2019, making it the second largest fintech market in Asia behind China, data compiled by analytics firm FinTech Global revealed.

For 2019 alone, local fintech firms raised $5.1b from 154 deals. However, this did not reach the $8.2b mark in 2017 through 116 transactions.

Whilst funding plummeted in 2018, with total investment volume only reaching $1.7b, the country looks to be thriving, noted FinTech Global. The average deal size has grown from $32.1m in 2015 to $38.9m in 2019, indicating that India’s fintech sector has matured over the period, the report noted.

“The sector has drawn in a lot of big deals over the years. E-commerce platform Flipkart has been responsible for a number of these, having secured a number of billion dollar deals. US retail company Walmart acquired a 77% stake in the business in 2018 in a deal allegedly worth around $16b,” the report read.

In the past year, the five biggest fintech deals in the country include online credit provider PaySense, which received a $185m investment from Dutch paytech company PayU, a deal that saw PayU pick a controlling stake in the firm; Navi Technologies, a developer of consumer-centric technology for banks, which raised $394.2m in a funding round led by Flipkart co-founder Sachin Bansal; Digit Insurance, which scored $84m in an investment round; Digital marketplace Vivriti Capital, which closed a $50m funding round earlier this year; and Fusion Microfinance, which raised $70.5m.

Since 2015, $98.1b has been invested into fintech companies based in Asia, of which Chinese companies have received 67.1%. India follows suit, with local companies having picked up 17.9% of the total funding in Asia.

Advertise

Advertise