Australia's fintech deal activity slumps anew in Q2

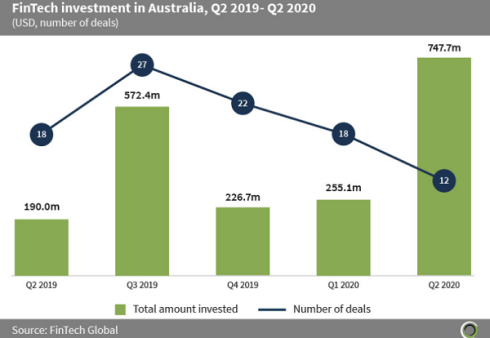

Only 12 transactions were recorded compared to 18 in Q1.

Australian fintech deal activities fell for the third straight quarter in Q2, with the country on track to record its worst deal activity since 2016, according to a FinTech Global report.

Only 12 transactions were recorded in Q2 compared to 18 in Q1. The number of transactions in the first half of the year was 25% lower than the same period in 2019.

On the other hand, funding in Q2 reached a five-quarter high on the back of two separate deals by SME challenger bank Judo Bank. In one deal, the bank raised $500m with the help of the government to provide loans to small businesses.

Australian neobanks comprised the top five fintech deals in the country, collectively raising a total of $944m or 94.1% of investments in H1 2020.

Total capital invested by fintechs grew at a CAGR of 75.1% from $215.3m in 2016 to over $1.1b in end-2019.

Advertise

Advertise