Why Singapore is well-equipped to facilitate RMB trading

By Nathan Chow Hung Lai (周洪禮) On 8 February, the People's Bank of China announced that the Industrial and Commercial Bank of China (Singapore) will become the RMB clearing bank in

Singapore.

This appointment was widely expected as Beijing indicated a Chinese clearing bank will be designated in the city-state in a top bilateral meeting held last year.

Singapore has long-prepared for and is well equipped to facilitate RMB trading. The Singapore Exchange has laid the ground for the listing of RMB-denominated securities.

As Asia's second largest FX trading center, Singapore houses many multi-national corporations' treasury centers as well as offshore trading operations. Once the clearing mechanism is set up, there will be greater transparency in the movement of RMB funds.

Market confidence in accepting RMB for trade settlement will increase. In turn, this will encourage more participation from corporations and banks, potentially increasing the range of RMB investment products.

To seize the rapidly growing pie, banks in Singapore began offering RMB banking services a few years ago. As of June 2012, the pool of RMB deposits in Singapore reached RMB60 billion.

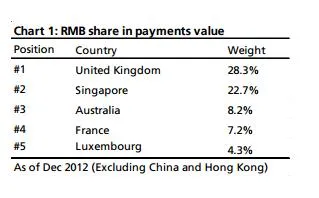

RMB flows in Singapore have been buoyed by the healthy growth of trade and financial linkages with the mainland. China was Singapore's third-largest trading partner; total trade between the two countries reached SGD104 billion in 2012, up 37% since the 2008 global crisis. Excluding China and Hong Kong, Singapore currently handles the largest share of RMB payments in Asia (Chart 1).

Aside from financial infrastructure and economic ties, Singapore possesses a key geographical advantage. As the gateway to the Southeast Asia, it provides a platform for Beijing to facilitate wider use of the RMB in China-ASEAN trade.

In 2012, ASEAN exports to China grew to USD195.8 billion from USD22.2 billion in 2000; surpassing Japan to become China's second largest importing region (Chart 2).

China's imports from ASEAN include mainly commodities and raw materials such as petrol and timber. China's demand for commodities is expected to remain strong going forward and China is happy to see more trades settled in RMB.

Furthermore, as the RMB's regional influence continues to grow, the RMB clearing line will be utilized by not just Singapore but its trade partners too. This is a great opportunity for Beijing to promote the "third party" usage of the RMB (trades not involving China), a major attribute of any international currency.

Advertise

Advertise