Mambu CEO & Co-Founder Eugene Danilkis talks about how incumbents can take on FinTech challengers

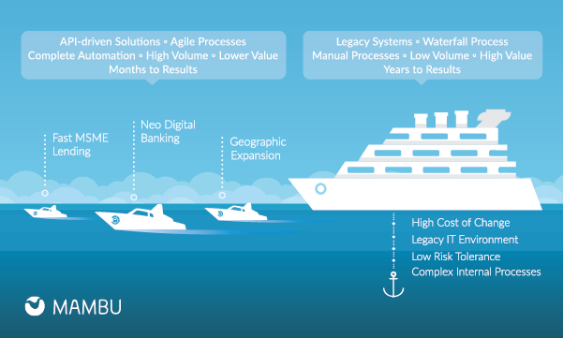

It is like launching speedboats from cruise ships.

Digital technology has changed financial services and is being driven by new entrants that possess characteristics that are increasingly important to consumers and shareholders: the ability to be lean and agile, provide a best-in-class user experience, as well as grow and scale rapidly.

Established institutions are starting to realise that legacy technology and the old way of doing business no longer works. McKinsey estimates that legacy financial institutions will see profits decline by up to

60% by 2025 if they fail to evolve, a figure which should be motivating incumbents to look outside of traditional practices for growth and sustainability.

Growth opportunities

Long term growth lies in geographic expansion, improving customer experience and focussing on underserved markets and SMEs. The right level of service can win over digital natives and the large millennial

markets which have ignored traditional banks in search of mobile alternatives. SME lending also offers a significant opportunity for growth. McKinsey has identified a $350 billion untapped lending opportunity within this sector which has numerous new entrants using digital technology to navigate a complex lending environment.

If banks and lenders are willing to change their thinking and take a digital approach now, they can benefit from the same opportunities as they have a distinct advantage, the ability to leverage their balance sheet to help them navigate a rapidly evolving market.

Launching speedboats

The simplest route is to build a digital banking spinoff which can operate like a FinTech. If we look at established banks as cruise ships: large, expensive to operate, process heavy and slow to manoeuver, the spinoff can be seen as a speedboat: independent, cost-effective, agile and lean. It can be launched within twelve months,

unrestricted by geography and able to penetrate new markets.

A spinoff has to be seen as an investment in an innovation arm, created to address a specific market need and unimpeded by traditional organisational processes. If allowed the freedom, it could leap ahead technologically by prioritising APIs, cloud and mobile first thinking, and being able to demonstrate results in a short period of time.

Banks can derive value by leveraging technology to streamline operations, automate processes and significantly reduce overall cost of doing business. Focus can shift from internal systems and processes to the delivery of better service and growth.

New people, thinking and processes

Technology, while a differentiator, is just one cog in the machine. Real transformation is only possible with a change of people, thinking, and processes. This means new leadership incentivised to drive success of the spinoff and not conflicted between the bigger organisation and the new venture. This leadership has to instill a culture of innovation and continuous change from the start to enable it to act like a startup without being held back by legacy processes.

Learn from the market

Through digital spinoffs, they can allow themselves the flexibility to play at speeds at which startups operate.

They will be able to innovate, explore new growth areas and quickly change direction, and in the process, redesign banking for the 21st century.

Advertise

Advertise