Thailand’s Beam raises $2.5m in seed funding

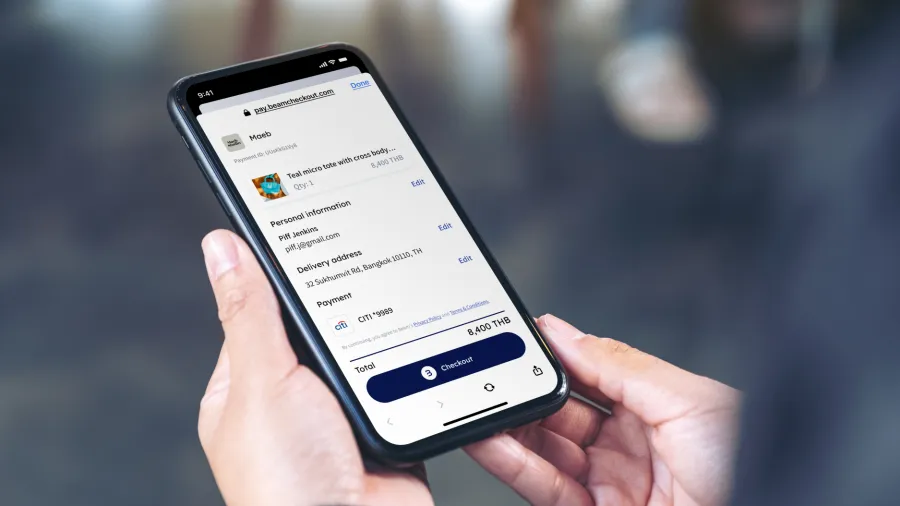

Beam offers a one-click checkout solution for seamless payments.

Thailand-based startup Beam has raised $2.5m in seed funding, led by Surge, Sequoia Capital India, and with participation from Partech partners.

Beam offers a one-click checkout solution that enables frictionless payment for Southeast Asia’s e-commerce platforms.

In a press announcement, Beam said that it will use the funds to expand its services in Thailand and across the region, increase its hiring, and grow its merchant base.

“The online checkout experience should be as easy as tapping a physical card for payment,” said Win Vareekasem, co-founder and CEO of Beam. “Shoppers should be able to shop wherever they want, and check out with just one click. We believe that these seamless journeys will help drive e-commerce and social commerce maturity among digital users in Southeast Asia even further.”

Beam shared that brands using its solution have boosted checkout success rates by up to 30%, and benefitted from greater cost savings as they only pay a low transaction fee.

Advertise

Advertise