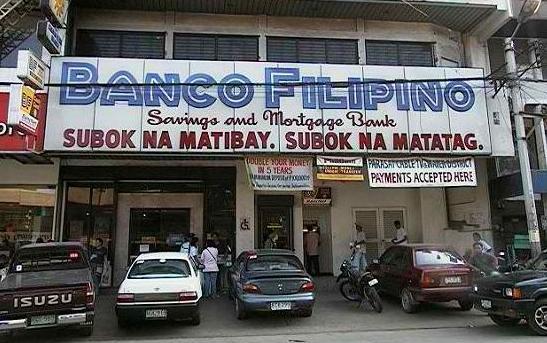

Banco Filipino does a phoenix--for the second time

A leading Philippine savings bank shuttered twice by the government in a span of 25 years is to re-open for the second time this March.

The Philippine Court of Appeals has just ruled illegal the March 2011 closure of Banco Filipino Savings and Mortgage Bank by the Bangko Sentral ng Pilipinas, the central bank.

The court ordered the central bank to reopen Banco Filipino and provide it with US$587 million in financial assistance. The court order is "immediately executory" even if the central bank appeals the decision, claimed Banco Filipino Vice Chairman Perfecto Yasay.

He said the only thing that can stop his bank's reopening is a temporary restraining order from the Supreme Court.

In a 50-page decision last Jan. 27, the court ruled that Banco Filipino "was not accorded due process" when it was placed under receivership. The court also found that the bank was not insolvent as claimed by the central bank and its Monetary Board.

The Monetary Board issued a resolution on March 17, 2011 placing Banco Filipino under receivership for failing to service withdrawals and fund issued checks.

It claimed that the bank's liabilities exceeded its assets by P8.4 billion. The bank was also prohibited from continuing its business operations in the Philippines due to "unsound banking practices."

The central bank shut down Banco Filipino in 1985, claiming it was insolvent. In 1991, however, the Philippine Supreme Court said the closure was illegal, paving the way for the bank's re-opening in 1994.

Advertise

Advertise