Chart of the Week: Open banking behaviour strengthen in APAC

Around 30% said that they are open to sharing their data in relation to online purchases.

The lasting impact of COVID-19 on banking behaviour will amplify the application of open banking, according to data and analytics company GlobalData.

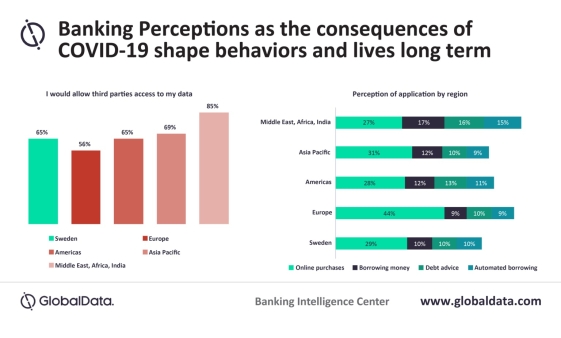

A total of 69% of bank customers in APAC are open to sharing their financial data with third-party providers of their choice, a study by the analytics firm revealed.

By segments of application, 31% said that they are open to sharing their data in relation to online purchases; 12% cited borrowing money; 10% named debt advice; and 9% cited automated borrowing.

Across markets, 85% of those surveyed in Middle East, Africa, and India said that they are open to sharing their data with third-party firms. Meanwhile, 65% in the Americas and 56% in Europe said the same.

In Sweden, the new partnership between banking and insurance company Resurs and the platform Nordic API Gateway is an example of how the pandemic is amplifying the application of open banking in the region, according to GlobalData.

Increased social distancing and preference for online methods of shopping and purchasing will see a rise in customers who use open banking platforms due to them being able to complete transactions online without divulging sensitive payment information, thereby reducing the risk of fraud, the analytics firm noted.

This give the likes of Resurs a new-found competitive advantage that can be leveraged to increase its customer base and more dynamically challenge incumbent banks, it added.

“The partnership makes sense for Resurs, as GlobalData’s 2020 Financial Services Consumer Survey found that the Swedish market is one of the most receptive to open banking reforms in the world, trailing the likes of Singapore and Malaysia but leading London, despite it being the fintech hub of Europe,” said Muhammed Hasan, retail banking analyst at GlobalData.

Further, it will allow Resurs to access financial data and account-to-account payments for any of its 6.2 million customers in the Nordic region who choose to opt in and make use of the service.

“Resurs intends to use such data to offer tailor-made loan products to customers, which will be based on a real-time understanding of customer financial behavior,” said Hasan.

Advertise

Advertise